Today, Lloyd Banking Group, LBG, after a deal with officials and advisors of the HM Treasury Team (pictured), became a government controlled bank. The Treasury Team should never be under-estimated. These are heavyweights. If they were a rugby team they would look like a front row. If HM Treasury was a bank, and actually it is, arguably more of a bank than the Bank of England, it could be classed as the world's biggest after the US Treasury, including as it does the world's biggest commercial bank holding company, UK Financial Investments Ltd. (Assets about $4 trillions). But as in any bank's published accounts you will not find more than the tip of the iceberg of transactions data, and the big ticket items are off-balance-sheet. The media write of taxpayers money to bail out banks and taxpayers taking over Bank A or B and having the right to worry about that. But will this so-called taxpayers money appear in the budget plan and accounts to be presented to Parliament very soon - er, no!

Today, Lloyd Banking Group, LBG, after a deal with officials and advisors of the HM Treasury Team (pictured), became a government controlled bank. The Treasury Team should never be under-estimated. These are heavyweights. If they were a rugby team they would look like a front row. If HM Treasury was a bank, and actually it is, arguably more of a bank than the Bank of England, it could be classed as the world's biggest after the US Treasury, including as it does the world's biggest commercial bank holding company, UK Financial Investments Ltd. (Assets about $4 trillions). But as in any bank's published accounts you will not find more than the tip of the iceberg of transactions data, and the big ticket items are off-balance-sheet. The media write of taxpayers money to bail out banks and taxpayers taking over Bank A or B and having the right to worry about that. But will this so-called taxpayers money appear in the budget plan and accounts to be presented to Parliament very soon - er, no! How should we understand this? Are taxpayers being burdened with financial risk or future long term debt, or not? Is taxpayers creditworthiness being leveraged, borrowed against, future revenue streams packaged up like securitised bonds have packaged up anything from mortgages and credit card receipts to insurance premiums and lease-finance hire-purchase payments? Is the money in some abstract way coming from 'the real economy' so-called, from real taxpayers, and are any gains or losses going to the accounts of taxpayers or somewhow to and from the whole economy? How can these numbers we read about grow to be the same size as GDP (annual National Income) or even be several times bigger? What is the real budget deficit, the real national debt today? It may sound irritating, amusing or churlish, but it would not be far-fetched, impractical, or unrealistic, to answer that actually all this is part of a 'parallel financial universe', certainly not directly part of National Income and Expenditure, not on the Government's HM Treasury budget, and only about as connected to taxpayers and the real or main economy as the huge turnover of financial transactions in the global financial markets churning through London are so connected.

How should we understand this? Are taxpayers being burdened with financial risk or future long term debt, or not? Is taxpayers creditworthiness being leveraged, borrowed against, future revenue streams packaged up like securitised bonds have packaged up anything from mortgages and credit card receipts to insurance premiums and lease-finance hire-purchase payments? Is the money in some abstract way coming from 'the real economy' so-called, from real taxpayers, and are any gains or losses going to the accounts of taxpayers or somewhow to and from the whole economy? How can these numbers we read about grow to be the same size as GDP (annual National Income) or even be several times bigger? What is the real budget deficit, the real national debt today? It may sound irritating, amusing or churlish, but it would not be far-fetched, impractical, or unrealistic, to answer that actually all this is part of a 'parallel financial universe', certainly not directly part of National Income and Expenditure, not on the Government's HM Treasury budget, and only about as connected to taxpayers and the real or main economy as the huge turnover of financial transactions in the global financial markets churning through London are so connected.  Most readers should at this point feel quite lost, as perplexed as they have a right to feel in front of a Picasso. Is this a global financial Guernica? Have we been bombed to shreds, or showered with money? Anyone who does not feel at least a bit lost, may I say you are uniquely strange, For more normal types, even all those working telephone numbers in banks, finding answers is surely like trying to find the light switch in a strange room. It's not by the door but under some elaborately fringed standing lamp by the Ming vase in the far corner, and to get there is an obstacle course of delicate groping in pitch-black by blind-touch through a treasure room of precious antiques!

Most readers should at this point feel quite lost, as perplexed as they have a right to feel in front of a Picasso. Is this a global financial Guernica? Have we been bombed to shreds, or showered with money? Anyone who does not feel at least a bit lost, may I say you are uniquely strange, For more normal types, even all those working telephone numbers in banks, finding answers is surely like trying to find the light switch in a strange room. It's not by the door but under some elaborately fringed standing lamp by the Ming vase in the far corner, and to get there is an obstacle course of delicate groping in pitch-black by blind-touch through a treasure room of precious antiques!  We have been living in a fiction for too long that everything government does financially is taxpayers income and expense. Er, sorry but no. Government is itself a financial behemoth, generating its own financial flows, its own output and income, with massive borrowing rights, enormous assets, huge creditworthiness. As taxpayers we are merely the equivalent of policy-holders paying our annual premiums, our daily and monthly duty-tax payments, and some of us making claims and all getting some services, access to roads, street lighting and sewage etc. sometimes cheques or giros in the post, and one in seven of us with jobs work directly for 'public services', most of those in education and health. Government is a 'mutual' financial institution and we are all, whether taxpayers or not, are policy and account-holders. And some of us are bondholders too. But we are not shareholders even if we do have shareholders votes every few years to appoint a new board or keep the existing one, and we get to appoint several hundred non-execs who we trust will do their best to hold the board to account. I can't decide if the democratic-taxpayer-fiction is also fact and should be cherished or challenged. But, I'm constantly being tasked at dinner parties or by friendly bar-flies with the question "well who's money is it then, where does it come from, are we paying for this or not?"

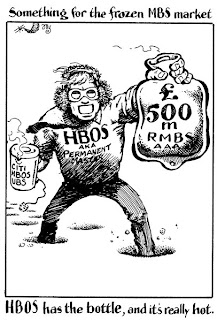

We have been living in a fiction for too long that everything government does financially is taxpayers income and expense. Er, sorry but no. Government is itself a financial behemoth, generating its own financial flows, its own output and income, with massive borrowing rights, enormous assets, huge creditworthiness. As taxpayers we are merely the equivalent of policy-holders paying our annual premiums, our daily and monthly duty-tax payments, and some of us making claims and all getting some services, access to roads, street lighting and sewage etc. sometimes cheques or giros in the post, and one in seven of us with jobs work directly for 'public services', most of those in education and health. Government is a 'mutual' financial institution and we are all, whether taxpayers or not, are policy and account-holders. And some of us are bondholders too. But we are not shareholders even if we do have shareholders votes every few years to appoint a new board or keep the existing one, and we get to appoint several hundred non-execs who we trust will do their best to hold the board to account. I can't decide if the democratic-taxpayer-fiction is also fact and should be cherished or challenged. But, I'm constantly being tasked at dinner parties or by friendly bar-flies with the question "well who's money is it then, where does it come from, are we paying for this or not?"  The public interest takeover followed LBG's ill-fated (in the short term) takeover of HBOS. Agreement finalised late last night, friday, will see 'the taxpayer' (actually, Government’s “arm’s length” agency UKFI Ltd.) take an economic stake of around 77 % with 65% voting rights in return for insuring £260bn of toxic assets at a fee cost of about 6% and the same again annually, based on the current credit default rates that have spiked up to 6% where they were briefly when Lehman Brothers collapsed. Lloyds shareholders can clawback some of the new shares at 38.43p per share—a slight discount to Friday’s closing share price, which is half what it was only days earlier. Lloyds is clearly too cash-strapped to pay the fees for this in cash, which greatly surprises me and suggests that while the Asset Protection Scheme (APS) route is available to it (the so-called asset insurance option) the Bank of England’s Liquidity Window is not.

The public interest takeover followed LBG's ill-fated (in the short term) takeover of HBOS. Agreement finalised late last night, friday, will see 'the taxpayer' (actually, Government’s “arm’s length” agency UKFI Ltd.) take an economic stake of around 77 % with 65% voting rights in return for insuring £260bn of toxic assets at a fee cost of about 6% and the same again annually, based on the current credit default rates that have spiked up to 6% where they were briefly when Lehman Brothers collapsed. Lloyds shareholders can clawback some of the new shares at 38.43p per share—a slight discount to Friday’s closing share price, which is half what it was only days earlier. Lloyds is clearly too cash-strapped to pay the fees for this in cash, which greatly surprises me and suggests that while the Asset Protection Scheme (APS) route is available to it (the so-called asset insurance option) the Bank of England’s Liquidity Window is not.  It has also been stated that LBG is paying more than what RBS paid a few days earlier – possibly on the day CDS spreads were lower? Lloyds will issue non-voting, dividend paying B shares to the Treasury (taking economic ownership interest to 77%) just to cover its £15.6bn fee to join the government’s APS. The media dub this a scheme for insuring “toxic assets”. Are they ‘toxic’. I doubt that. I suspect they are, if toxic, mostly already written-down assets and otherwise they are bonded assets containing mostly high-rated regular customer loans – but that’s just a guess. The real purpose is to provide funding for the bank’s ‘funding gap’ that just this Month became suddenly very expensive (spiking just as last March and again in September when Lehman Brothers collapsed and credit insurance jumped dramatically for which the market proxy are Credit Default Swap spreads) and cannot be obtained from private funding sources, not cheaply anyway, only from government and central banks by swapping loan assets for treasury bills. But then the government is not offering a cheaper deal either? In fact, one irony is that the cost of insuring bank credit has jumped precisely because of political fears, the fear that government may force bank bondholders to swap their bonds for equity shares.

It has also been stated that LBG is paying more than what RBS paid a few days earlier – possibly on the day CDS spreads were lower? Lloyds will issue non-voting, dividend paying B shares to the Treasury (taking economic ownership interest to 77%) just to cover its £15.6bn fee to join the government’s APS. The media dub this a scheme for insuring “toxic assets”. Are they ‘toxic’. I doubt that. I suspect they are, if toxic, mostly already written-down assets and otherwise they are bonded assets containing mostly high-rated regular customer loans – but that’s just a guess. The real purpose is to provide funding for the bank’s ‘funding gap’ that just this Month became suddenly very expensive (spiking just as last March and again in September when Lehman Brothers collapsed and credit insurance jumped dramatically for which the market proxy are Credit Default Swap spreads) and cannot be obtained from private funding sources, not cheaply anyway, only from government and central banks by swapping loan assets for treasury bills. But then the government is not offering a cheaper deal either? In fact, one irony is that the cost of insuring bank credit has jumped precisely because of political fears, the fear that government may force bank bondholders to swap their bonds for equity shares. Who or what has forced who into this deal is unclear. Maybe Lloyds found its access to the Bank of England (BoE) liquidity window for assets swaps for treasury bills is shut! Maybe the government needed to be seen to be doing something dramatic because CDS spreads have spiked up and therefore order Lloyds to the deal table by wielding a BoE stick and the only carrot being it was prepared to do a deal that in one go would supply the bank’s funding needs for all of 2009? But, where did the CDS spike come from?

Who or what has forced who into this deal is unclear. Maybe Lloyds found its access to the Bank of England (BoE) liquidity window for assets swaps for treasury bills is shut! Maybe the government needed to be seen to be doing something dramatic because CDS spreads have spiked up and therefore order Lloyds to the deal table by wielding a BoE stick and the only carrot being it was prepared to do a deal that in one go would supply the bank’s funding needs for all of 2009? But, where did the CDS spike come from?  CDS spreads represent the cost of buyin insurance cover for loan defaults in CDO, but not entirely that. CDOs (bonded combinations of corporate debt instruments and other ABS) and Synthetic CDOs are markets also unto themselves, greatly exceeding in face value the underlying assets. These are tradable insurance policies that because they move up and down in price are speculations where for very little downpayment very large bets can be taken. The market prices spiked up on news of problems including possible partial nationalisations of Citigroup and Bank of America, and following the ham-fisted announcement that AIG had drawn down $55bn of its standby $80bn already authorised to cope with a quarterly, mainly paper, loss of $60bn. This is the downside of globalised financial markets, a panic reasction in America travels round the globe and forces UK government to nationalise Lloyds.

CDS spreads represent the cost of buyin insurance cover for loan defaults in CDO, but not entirely that. CDOs (bonded combinations of corporate debt instruments and other ABS) and Synthetic CDOs are markets also unto themselves, greatly exceeding in face value the underlying assets. These are tradable insurance policies that because they move up and down in price are speculations where for very little downpayment very large bets can be taken. The market prices spiked up on news of problems including possible partial nationalisations of Citigroup and Bank of America, and following the ham-fisted announcement that AIG had drawn down $55bn of its standby $80bn already authorised to cope with a quarterly, mainly paper, loss of $60bn. This is the downside of globalised financial markets, a panic reasction in America travels round the globe and forces UK government to nationalise Lloyds.The prospect of increased government control will pile up resign pressure on Sir Victor Blank, the bank’s chairman and Eric Daniels, chief executive who orchestrated last year’s rescue deal to buy rival lender HBOS, which last week reported a £10.8bn loss.

Removing Daniels and maybe his team would I judge be a disaster. These are bankers who very much seem to know what they are doing and have implemented an intelligent approach to restructuring their bank. But even they cannot it seems move fast enough to avoid nationalisation. They could perhaps have done more before the merger to securitise and swap more assets and build a large funding surplus last year when the SLS was open. But that now is merely hindsight.

Removing Daniels and maybe his team would I judge be a disaster. These are bankers who very much seem to know what they are doing and have implemented an intelligent approach to restructuring their bank. But even they cannot it seems move fast enough to avoid nationalisation. They could perhaps have done more before the merger to securitise and swap more assets and build a large funding surplus last year when the SLS was open. But that now is merely hindsight.One large investor said last week that Sir Victor should resign given the damage that the ill-fated HBOS takeover had wrought on Lloyds. That is poor if coming from institutional investors who supported the merger, some of whom were looking to buy parts of the new group cheap, and all of whom have ample analysis and research to back their judgements.

Lloyds admitted to thje Treasury Committee that it would not have needed any taxpayer money if it had not bought HBOS and that it could have done more due diligence? £150m and 3,000 man-weeks or whatever the resource committed was, was not enough? That I don’t buy! If anything, Sir Victor and Eric could rue that they did not agree to the merger being referred to the Competition Commission, which would have given months more of time to plan and re-structure.

Eric Daniels told MPs that Lloyds had carried out ”three to five times” less due diligence than normal on HBOS’s balance sheet before agreeing the deal. That was probably true before 18 September, but should not have been true for the months thereafter. In any case, what we have here is further indictment of audit firms and annual and quarterly accounts presentations. Strictly speaking all that should be needed to know should be mostly gleaned from trustworthy published accounts.

Eric Daniels told MPs that Lloyds had carried out ”three to five times” less due diligence than normal on HBOS’s balance sheet before agreeing the deal. That was probably true before 18 September, but should not have been true for the months thereafter. In any case, what we have here is further indictment of audit firms and annual and quarterly accounts presentations. Strictly speaking all that should be needed to know should be mostly gleaned from trustworthy published accounts.The deal is will anger shareholders who believe buying HBOS severely damaged Lloyds like buying ABN AMRO damaged RBS. This is all true, except that Lloyds while not “directly” exposed to sub-prime and other toxic assets does have indirect exposures. These days bank CEOs have to become super-heroes, battling against time to save their banks and thereby save the world. Unfortunately ehat they have to say doesn't quite capture the excitement and drama of what they are up to.

Daniels, the Spiderman of LBG, said: ”Our significantly enhanced capital position will ensure that the group can weather the severest of economic downturns and emerge strongly when the economy recovers. We believe this is an appropriate deal for our shareholders.” I agree and trust him on this, but the question for shareholders is can they afford to hang around that long? Will he have any left by then. Avoiding 100%nationalisation is important, if for nothing else than to be in the stock-market when recovery returns and thereby greatly boosting the equity of the bank, hopefully by leaps and bounds, and thereby also profitably rewarding Government and having a transparant and open and regulated marketplace for formally attracting private investment to replace Government backing.

Daniels, the Spiderman of LBG, said: ”Our significantly enhanced capital position will ensure that the group can weather the severest of economic downturns and emerge strongly when the economy recovers. We believe this is an appropriate deal for our shareholders.” I agree and trust him on this, but the question for shareholders is can they afford to hang around that long? Will he have any left by then. Avoiding 100%nationalisation is important, if for nothing else than to be in the stock-market when recovery returns and thereby greatly boosting the equity of the bank, hopefully by leaps and bounds, and thereby also profitably rewarding Government and having a transparant and open and regulated marketplace for formally attracting private investment to replace Government backing.Lloyds had, in recent years especially, been seen as a prudent and cautious bank, even deeply traditional and over-conservative, hich is not really true, just more fiction, but I believe Daniels on that score of being conservatively risk-averse when reading and listening to his statements about the bank’s risk policies.

Many shareholders believe that the toxic assets sitting on HBOS’s balance sheet threaten to poison Lloyds long, medium and short term. I don't agree at all. Except for corporate lending to property companies, I see no other evidence of that. Mostly what we are dealing with here is waves of loss of confidence washing across the pond from the USA. And if problems do not hit banks from one direction it will be afrom another direction. Banks of all kinds and in all states iof health have been variously damaged.

Lloyds said on Saturday that APS scheme transfers significant risk away from shareholders and would significantly bolster its capital base. I think this is the wrong spin, far better to say it solves the funding gap refinancing problem! In time the HBOS deal will be a ”very good purchase” over time for the bank. I opposed this; after all what does any one bank matter in the wider scheme of things. What difference would it make if LBG is one bank or two banks? The only wider benefit is that one bank’s bad management is replaced with the combined bank’s much better management.

Lloyds said on Saturday that APS scheme transfers significant risk away from shareholders and would significantly bolster its capital base. I think this is the wrong spin, far better to say it solves the funding gap refinancing problem! In time the HBOS deal will be a ”very good purchase” over time for the bank. I opposed this; after all what does any one bank matter in the wider scheme of things. What difference would it make if LBG is one bank or two banks? The only wider benefit is that one bank’s bad management is replaced with the combined bank’s much better management.Daniels took a top-down very conservative view of the HBOS book which I find praise-worthy (see http://lloydsbankgroup.blogspot.com/2009/02/lbg-goodwill-hunting.html ).

Yet, the FT reports about the APS deal, “Details of the scheme show that around 83% of the assets which Lloyds plans put in the scheme are coming from the riskier loan books at HBOS. Lloyds said by putting the riskier HBOS assets into the scheme it has reduced the concentration of risk across the merged bank.”

But, the total of HBOS assets deemed riskier than Lloyds would have permitted is only about £160bn of which £80bn is ‘bad bank’ work-out assets that are remotely ‘toxic’, according to the February published 2008 annual reports. If ‘toxic’ is used generally for any loans where defaults are expected to rise higher than where they are today, then all asset classes, all risk bucket, are ‘toxic’. But, the better definition of ‘toxic’ is sub-prime mortgage-related securities, bank and non-bank corporate junk bonds, their credit derivatives, and equity and mezzanine tranches of related securitised bonds. Taking that more precise classification, therefore how can 83% (£216bn) be deemed relatively toxic out of the £260bn APS total?

But, the total of HBOS assets deemed riskier than Lloyds would have permitted is only about £160bn of which £80bn is ‘bad bank’ work-out assets that are remotely ‘toxic’, according to the February published 2008 annual reports. If ‘toxic’ is used generally for any loans where defaults are expected to rise higher than where they are today, then all asset classes, all risk bucket, are ‘toxic’. But, the better definition of ‘toxic’ is sub-prime mortgage-related securities, bank and non-bank corporate junk bonds, their credit derivatives, and equity and mezzanine tranches of related securitised bonds. Taking that more precise classification, therefore how can 83% (£216bn) be deemed relatively toxic out of the £260bn APS total?The 2008 annual reports were very conservative by using the worst M2M proxies of CDS spreads. Therefore, the underlying was probably not nearly so bad. All we really know is thatn around £74bn of the assets put into the scheme are residential mortgages, £18bn are unsecured personal loans, and £17bn is riskier Treasury assets linked to US sub-prime mortgages, or $109bn. £151bn - are corporate and commercial property loans written by HBOS’s corporate bank.

That is what LBG inherited from Mr Peter Cummings' dealings (he also of multi-million salary and multi-million pension bonus) and is the total HBOS corporate loan book. Maybe shareholders should sue him? But, these loans are all mostly highly-rated regular quality assets, except for about £80bn that needs special attention, and let’s not kid ourselves about property and construction loans, many property developers always go bust in any property market crash. We all know that, don't we? banks know to take these hits and move on. Lloyds under the scheme (on the now classic SIV securitisation model) will absorb the first 9.6% (late 2008 sub-prime default rate in the USA) or £25bn of losses and will retain a further 10 % of further losses and Treasury 90 % of further losses. The Treasury is only going to have to pay up if the roof is totally blown off our economy. This is Tsunami or Hurricane insurance. To get there, to loan loss provisions that the Treasury will pay compensation for, requires 300% increase in current default rates, and a 600% rise in only a year before it makes a cash-flow accounting loss! Lloyds’ £15.6bn fee to the Treasury will be amortised over a 7-year period, and therefore any pay-out maybe can be too. The proceeds of the fee will be applied by the Treasury in subscribing for B shares which are non-voting equity paying a dividend of 7 %. This is generous to HM Treasury, and no doubt why Lloyds prolonged the negotiation to try to get a better deal. Amortising any outcome though must have looked OK. For fuller discussion including about Quantitative Easing and how Bank of England cheques will replace treasury bills in this asset for funds swap see http://monetaryandfiscal.blogspot.com/

That is what LBG inherited from Mr Peter Cummings' dealings (he also of multi-million salary and multi-million pension bonus) and is the total HBOS corporate loan book. Maybe shareholders should sue him? But, these loans are all mostly highly-rated regular quality assets, except for about £80bn that needs special attention, and let’s not kid ourselves about property and construction loans, many property developers always go bust in any property market crash. We all know that, don't we? banks know to take these hits and move on. Lloyds under the scheme (on the now classic SIV securitisation model) will absorb the first 9.6% (late 2008 sub-prime default rate in the USA) or £25bn of losses and will retain a further 10 % of further losses and Treasury 90 % of further losses. The Treasury is only going to have to pay up if the roof is totally blown off our economy. This is Tsunami or Hurricane insurance. To get there, to loan loss provisions that the Treasury will pay compensation for, requires 300% increase in current default rates, and a 600% rise in only a year before it makes a cash-flow accounting loss! Lloyds’ £15.6bn fee to the Treasury will be amortised over a 7-year period, and therefore any pay-out maybe can be too. The proceeds of the fee will be applied by the Treasury in subscribing for B shares which are non-voting equity paying a dividend of 7 %. This is generous to HM Treasury, and no doubt why Lloyds prolonged the negotiation to try to get a better deal. Amortising any outcome though must have looked OK. For fuller discussion including about Quantitative Easing and how Bank of England cheques will replace treasury bills in this asset for funds swap see http://monetaryandfiscal.blogspot.com/At my dining table I've noticed HM Treasury officials getting more attention that investment bankers. As a sign of the times the latest James Bond, Casino Royale, features an HM Treasury agent, 'Vesper Lynd', assigned to supervise Bond and finance his poker table exploits.

That sums up exactly what we want, someone to supervise our banks gambling habits. It is in this context we also have to understand the Asset Protection Scheme, APS. LBG is the second bank to take advantage of the government’s APS after RBS announced it was putting £325bn of assets into the scheme in a move which is expected to lift the state’s 70 % ‘economic stake’ in RBS up to as much as 95 %. The government’s voting stakes in both banks will be capped at 75 %, which is the threshold in the USA before the balance sheets come ‘on-budget’ of Federal finances, and may be the threshold operating in UK also.

That sums up exactly what we want, someone to supervise our banks gambling habits. It is in this context we also have to understand the Asset Protection Scheme, APS. LBG is the second bank to take advantage of the government’s APS after RBS announced it was putting £325bn of assets into the scheme in a move which is expected to lift the state’s 70 % ‘economic stake’ in RBS up to as much as 95 %. The government’s voting stakes in both banks will be capped at 75 %, which is the threshold in the USA before the balance sheets come ‘on-budget’ of Federal finances, and may be the threshold operating in UK also.Lloyds’ fee is high compared with the £6.5bn fee paid by RBS to insure £325bn of assets. Why? I do not believe that LBG’s assets are more toxic than RBS assets given RBS’s much larger US exposure especially via Greenwich Capital? I suspect it may reflect the innovative style of LBG’s risk accounting and its more conservative and global assessment than RBS’s accounting. If so, then that is an unfair and unreasonable penalty for being more risk averse and more honest about accounting standards! I suspect Daniels found himself unfairly cornered between ‘the fire hydrant’ and the ‘junkyard dog’ (my new kindly-meant terms for HM Treasury and the FSA). RBS will only shoulder the first 6%, or £19.5bn, of its assets defaults. This seems unfair. It may have something to do with differences between LBG’s SIV structures and RBS’s SIVs or covered bonds given that RBS’s US$ assets have the benefit of a 30% exchange rate gain against sterling with which to offset credit risk losses? However, unlike RBS, Lloyds is not giving up tax credits to help reduce its fee. RBS gave up £4.6bn of tax credits to help pay for the scheme. Also unlike RBS which raised £13bn of extra capital to help cover its first losses, Lloyds is not raising any fresh capital. Lloyds will also gain £194bn of expected risk weighted asset tax relief compared to £144bn at RBS because the riskier loans put into the scheme will have required Lloyds to hold a high level of capital against them. Lloyds said that as a result of the new B shares and conversion of preference shares, its core tier one capital ratio- a measure of financial strength - will jump from 6.4 per cent to 14.5 per cent. This is high.

As part of the deal Lloyds has said it will increase lending to mortgage borrowers and small firms. It will offer a further £3bn of mortgage lending and £11bn of small business lending in the next 12 months. A further £14bn is committed for the 12 months thereafter. To my mind that seems not a lot of growth on the £1tn or so of assets left on the bank’s books! It might be something if despite all the restructuring this year the bank’s domestic loans will be £14bn higher at the end of 2009 than at the beginning of the year!

As part of the deal Lloyds has said it will increase lending to mortgage borrowers and small firms. It will offer a further £3bn of mortgage lending and £11bn of small business lending in the next 12 months. A further £14bn is committed for the 12 months thereafter. To my mind that seems not a lot of growth on the £1tn or so of assets left on the bank’s books! It might be something if despite all the restructuring this year the bank’s domestic loans will be £14bn higher at the end of 2009 than at the beginning of the year!

No comments:

Post a Comment